Shownotes

Wisdom-Trek / Creating a Legacy

Welcome to Day 322 of our Wisdom-Trek, and thank you for joining me.

This is Guthrie Chamberlain, Your Guide to Wisdom

4 Financial Lessons from Baseball

Thank you for joining us for our 7 days a week, 7 minutes of wisdom podcast. This is Day 322 of our trek. Yesterday, we stopped by the baseball fields and discovered 9 Life Lessons from Baseball. It is such a beautiful spring day that today we will stay at the ball fields and explore what baseball can teach us about our finances.

Thank you so much for coming along with me as we discover that each event of our daily trek in life, whether small or large, is packed with wisdom and insight that we can learn and apply to our lives to expand our living legacy. These bits of wisdom will help us to live a rich and satisfying life that we were created for. While some of our daily treks are a multi-part series, you can join us at any time and start along with us from that point on. If you would like to listen to any of the past episodes, please go to Wisdom-Trek.com to listen to them and read the daily journal. You can also subscribe to Wisdom-Trek on iTunes, Spreaker, Stitcher, Soundcloud, and Google Play, so each day’s trek will be downloaded to you automatically.

We are broadcasting from our studio at The Big House in Marietta, Ohio. Late afternoon on Friday we headed north once again for a little over two weeks. There is much work planned on and around The Big House as the weather is starting to warm up and the leaves on the trees are being released from their winter hibernation. While owning the old family homestead is rewarding and an integral part of our long-term legacy, it is a lot of responsibility and work. It also takes a lot of financial resources to maintain and renovate it. Paula and I are very serious when it comes to managing and controlling our financial foundation. While we have had our share of financial ebbs and flows during the past 37 years, we are always learning on how better to control our financial position without it controlling us.

Keeping with our focus from yesterday of learning life’s lessons from baseball today we want to learn:

4 Financial Lessons from Baseball

For many people, especially in the US, there is nothing like the start of the baseball season. Even though the season seems ceaselessly long, there is something about the anticipation of the Opening Day of baseball games. It means spring is right around the corner.

Although I am not a sports fanatic myself, one thing I love about sports is the analogies that can be made to our trek of life. I really think any philosophy of life can be explained through sports analogies. The importance of teamwork in winning games and getting things done successfully in life cannot be ignored. Doing the hard work behind the scenes will usually lead to a good performance on the field and in your life or career. The analogies are endless. There is probably no sport more open to analogies than baseball. After doing some thinking, there are a good number of analogies that can apply to personal finance. Even if you are not a huge sports fan, I think you will be able to relate to these analogies.

1. Good pitching is essential, but you need to score runs to win.

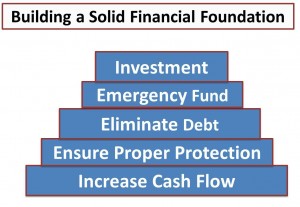

Increasing your personal cash flow is a simple proposition. Increase the amount of money coming in and decrease the amount of money going out. Make more money and spend less of it. In baseball terms, that means score more runs and don’t let the other team score runs. Having a good set of pitchers and sound defensive play from your fielders will keep the opponent’s runs to a minimum. But this alone is not going to win you the championship. You need to be able to put runs up on the board to make up for any inevitable mistakes from the defense.

This means that having a budget and watching where your money goes is not enough in itself. Sometimes we spend too much on food in a month. A car repair is needed. An impromptu vacation is booked. Things fall through the cracks sometimes, so it’s important we put extra effort into setting money aside as well. It can make up for any small mistakes we make and keep our cash flow positive. In addition to saving money in an emergency fund, it is crucial to build into your life multiple streams of income to guard against the slumps the will come.

Putting in place a good, but frugal spending plan is necessary and can put you in a great position financially, but to expand your resources, you need to have backup plans, just like baseball teams have backup players to fill in when needed.

2. You’re eventually going to swing and miss. You just have to learn from it.

Legendary Boston Red Sox player Ted Williams famously said, “Baseball is the only field of endeavor where a man can succeed three times out of ten and be considered a good performer.” A 30% hit rate is awesome in the baseball world, but is terrible in everything else. Something useful can be gleaned from these words though, which is that failure is inevitable. You can literally plan for it. There is no one who has never made a mistake at some point when it comes to their finances. In our situation, it was business decisions that did not turn out well and impacted us in a major way financially. For you, it may be a poor mutual fund selection, higher than expected credit card bills, or a home improvement project that just won’t stay under budget…Mistakes will be made.

The important thing is to learn from them and become wise financially. Also, learn from the mistakes of others and avoid those situations.

3. Put your pitcher in the best position possible to win the matchup.

One struggle that baseball managers have is to know when to replace the starting pitcher and go to the bullpen. Choosing the best relief pitcher can be a tricky choice. Some pitchers pitch better at home. Some are better at night. Some are terrible against certain hitters. All these variables must be considered before choosing the pitcher that will give you the best chance to win.

Personal finance is no different. Someone who has a lot of credit card debt and someone who has none should not be doing the same thing with their money. If you have a lot of debt, you may have to get by with a smaller emergency fund while paying down your debt. If you have no debt, you can save up for a more comfortable emergency fund and invest some money as well. You may want to go into business for yourself or invest in tax-deferred financial tools, which can have some tax benefits. Everyone has a different situation, and there is no one answer to solve everyone’s issue. The best action is to analyze where you are and where you want to be and find the most efficient way to get there.

4. The season is a marathon, not a sprint.

A Major League Baseball team has to play 162 games in the regular season. That’s a whole lot of games. Players can get worn down, worn out, become injured, and lose morale. The important thing to do is to keep the goal in sight. While the goal for the teams is to win the World Series, it happens by winning one game at a time. Once a game is over, win or lose, you have to focus on winning the next game.

So it is with your finances. You win by decreasing your debt and increasing your savings one dollar at a time. Yes, you have to have financial goals in mind, but every decision to either spend or invest each dollar will determine if you are successful. Wise financial decisions are crucial, so if you are going to play ball, play to win.

As you become successful in your finances by making wise choices, you should keep in mind the words that Paul wrote in his first letter to his apprentice in Timothy 6:17-19, “Teach those who are rich in this world not to be proud and not to trust in their money, which is so unreliable. Their trust should be in God, who richly gives us all we need for our enjoyment. Tell them to use their money to do good. They should be rich in good works and generous to those in need, always being ready to share with others. By doing this they will be storing up their treasure as a good foundation for the future so that they may experience true life.”

It has been an enjoyable two days at the ball field where we learned much about life and finances. Tomorrow we will hike the trail of a life well lived. So, encourage your friends and family to join us and then come along tomorrow for another day of our Wisdom-Trek, Creating a Legacy.

That will finish our trek for today. Just as you enjoy your daily dose of wisdom, we ask you to help us grow Wisdom-Trek by sharing with your family and friends through email, Facebook, Twitter, or in person so they can come along with us each day.

Thank you for allowing me to be your guide, mentor, and most of all your friend as I serve you through the Wisdom-Trek podcast and journal each day.

As we take this trek together, let us always:

- Live Abundantly (Fully)

- Love Unconditionally

- Listen Intentionally

- Learn Continuously

- Lend to others Generously

- Lead with Integrity

- Leave a Living Legacy Each Day

This is Guthrie Chamberlain reminding you to Keep Moving Forward, Enjoy Your Journey, and Create a Great Day Every Day! See you tomorrow!