Shownotes

Wisdom-Trek / Creating a Legacy

Welcome to Day 743 of our Wisdom-Trek, and thank you for joining me.

This is Guthrie Chamberlain, Your Guide to Wisdom

The Wisdom of Credit Cards – Ask Gramps

Thank you for joining us for our 5 days per week wisdom and legacy building podcast. This is Day 743 of our trek, and it is time for our Philosophy Friday series. Each Friday we will ponder some of the basic truths and mysteries of life and how they can impact us in creating our living legacy. As we continue on this trek called life, sometimes we have questions about life, so our Friday trek is a time where we can “Ask Gramps.”

Gramps will answer questions that you would like to ask your dad or granddad, but for whatever reason are unable to. No matter how old we are, I know that all of us would like the opportunity to ask Dad or Gramps questions about life in many areas. We will address areas such as finances, relationships, health/fitness, business/work, home repairs/renovations, seasons of life, spiritual/Biblical questions, and any others that come our way.

As your fellow sojourner and mentor on this trek that we call life, it is my goal to provide you with practical wisdom and advice about any area of life. It is crucial that I receive a constant flow of questions, so please submit your questions to guthrie@wisdom-trek.com, send me a message at the bottom of any page on wisdom-trek.com, or text me at 740.350.5732. And I will answer your questions on our Friday podcast.

We are broadcasting from our studio at The Big House in Marietta, Ohio. As we now enter the holiday season of Thanksgiving, Christmas, and New Years, many people in the western countries will be faced with the choice of how much they should spend on gifts for family and friends.

Most of us are tempted to spend more than we really should. The unfortunate reality is that many people also make these purchases with credit cards when they have no plan or idea of how they will afford those same purchases. So the question for today is:

“Hey Gramps, is it wise to use credit cards, or do you advise not using them at all?”

The Wisdom of Credit Cards

This is a tough question because there are no clear-cut answers. Some financial advisers, such as Dave Ramsey, teach that you should never use credit cards, and I understand why he teaches that. Many people do not have the financial discipline to use them prudently and effectively.

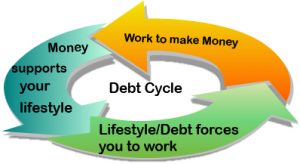

So my answer is, it depends. If you know that you are not disciplined financially, I would strongly suggest not using credit cards at all. They make it too easy to get trapped into the never-ending cycle of mounting debt, which can shackle you into the prison of financial bondage and limit the choices that you can make. When you are shackled financially, you are not be able to take advantages of wise choices and investments. You will be ever chained to a life of mediocrity with limited paths to free yourself. You will become a slave to the lender, or in this case, the loan sharks which we nicely refer to as credit card companies.

Uncontrolled credit card debt has destroyed marriages, uprooted families, and has caused untold misery to millions of people. As we are told in Proverbs 22:7, “Just as the rich rule the poor, so the borrower is servant to the lender.”

The sad part of this situation is that most credit card purchases are for things you don’t really need to impress people you don’t really like. When you are on a tight budget, it is nearly impossible to climb out of the abyss of credit card debt unless you are fully committed to making the sacrifices that are needed.

With that being said, you probably think that Gramps is completely against any use of credit cards, but that is not true. In fact, using credit cards prudently and wisely can actually make you money. You might be thinking, “Gramps, that is not possible.”

But let me share how Granny and I have used credit cards over several decades and have literally made several thousand dollars doing so. We currently have two active businesses, so we have three credit cards that we use on a regular basis. One card for purchases in each of the businesses and one for personal purchases. Let me share the four uncompromising rules for wise use of credit cards.

First, never use a credit card that charges you an annual fee just to have it, such as American Express. There is no logical reason to pay for a credit card just to be a member. It is usually to build a person’s ego, and there is no room for ego with finances.

Second, only use credit cards that pay you cash back bonuses for every dollar you spend using the credit card. These cash back bonuses will range anywhere from 1% to 3% of your purchases, and sometimes higher for special promotions.

Third, never purchase something on a credit card unless you already have the money in the bank to pay for that purchase. Never anticipate that you will have the money when it is due, too many times you will get over-extended or anticipated income does not arrive on time.

Fourth, always pay your credit card bill in full when it is due every single month, no exceptions.

I have to admit that Granny and I are very prudent and careful with our spending and money that we earn. So let’s assume that you are financially disciplined and you are able to comply with the four rules listed above. Here is how Granny and Gramps use three credit cards effectively.

Nearly all purchases that we make are put on one of our three credit cards, depending on which business is making the purchase or if it is a personal purchase – this includes office supplies, computer equipment, software, groceries, fuel, personal items, utility bills, medical and dental bills, and any other business or household items. This can add up to several thousand dollars per year. Even if you have a modest budget, it would also add up to several thousand dollars over a years’ time.

If you strictly follow the four credit card rules, there are two ways where you have the potential to earn money instead of paying interest and fees. First, if you have a savings account, the time between your purchase and when the credit card statement is due can range from 30 – 45 days. You can earn interest on your money during this time. Second, if you put nearly all your purchases on your credit card, then you are earning 1-3% back on those purchases.

On a monthly basis, this may not be a huge amount, but pennies add up to dollars, and dollars can add up to substantial money. If you are disciplined enough to follow these rules, then on $20,000 worth of purchases applied to a credit card you can earn $200 to $500 more per year of free money.

Most credit card users, especially if they are only making minimum payments, don’t realize that they end up paying several thousands of dollars in interest and fees over the course of a year. If you earn a few hundred dollars instead of spending a few thousand in fees and interest, that can add up to a lot of money.

Being debt free is so liberating. It is a feeling that is hard to describe. Your choices are so much greater. The financial pressures are so much less. The conflicts in a family are minimized.

It has not been easy for Granny and Gramps to continually make the financial sacrifices that we have over the years, but it is worth it. We are still very frugal with our money, but it allows us to help others and to have the resources to play a small part in the furtherance of God’s kingdom.

For many who find themselves drowning in credit card debt, it is because of their love for money. Even when they do not really have money, they crave it. As we are instructed by the Apostle Paul in 1 Timothy 6:10, “For the love of money is the root of all kinds of evil. And some people, craving money, have wandered from the true faith and pierced themselves with many sorrows.”

There are few situations in life that cause so much stress and hardship than what is brought on by living in debt when it is not necessary. You can still have a blessed and enjoyable Christmas and holiday season without going into debt to do so. If you do use credit cards, follow the four rules mentioned, and you will live free from the shackles of debt.

If you have any questions or comments about today’s question and answer, please leave me a comment on Wisdom-Trek.com or email me at guthrie@wisdom-trek.com

Next week we will have another question to “Ask Gramps.” Gramps will answer any questions you may have about life and will provide you with practical wisdom about any area of life. Please submit questions that you have to guthrie@wisdom-trek.com, and Gramps will answer them on our Friday podcast with wisdom and philosophy that Gramps has gained over the years of experience and study.

I know you will find these insights interesting, practical, and profitable in living a rich and satisfying life. Our next trek is Mindshift Monday where we will help you live differently by thinking differently. So encourage your friends and family to join us and then come along on Monday for another day of our Wisdom-Trek, Creating a Legacy.

If you would like to listen to any of the past 742 daily treks or read the associated journals, they are all available at Wisdom-Trek.com. You can also subscribe to iTunes or Google Play so that each day’s trek will be downloaded automatically.

As we take this trek of life together, let us always:

- Live Abundantly (Fully)

- Love Unconditionally

- Listen Intentionally

- Learn Continuously

- Lend to others Generously

- Lead with Integrity

- Leave a Living Legacy Each Day

This is Guthrie Chamberlain reminding you to Keep Moving Forward, Enjoy Your Journey, and Create a Great Day Every Day! See you on Monday!