Shownotes

Is a massive federal tax credit about to transform American education? 🎓

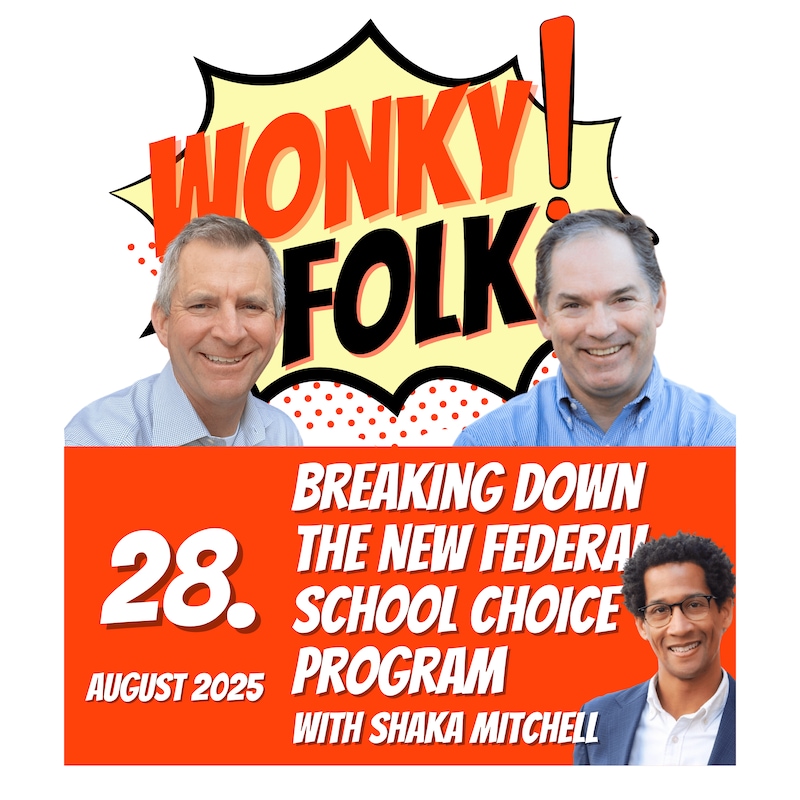

Join Jed Wallace and Andy Rotherham as they dive deep with Shaka Mitchell from the American Federation for Children into what could be the most significant school choice development in years. This isn't your typical education policy discussion – it's about a "seismic" shift that could reshape how families access educational options nationwide.

🎙️ What You'll Discover:

• The federal tax credit program that's flying under the radar

• What this means for families nationwide

• Why this policy could be a game-changer for low-income families

• What are SGOs, and how they will play a key role

• How it can look different in different states

🔥 Why This Matters:

While everyone's focused on the usual education debates, a quiet revolution in school choice funding might be happening right under our noses. Don't miss this insider perspective on what could be the next big thing in education policy.

📺 Perfect for: Education leaders, policy wonks, parents exploring school options, and anyone curious about the future of American education.

📚 Show Notes & Resources

Transcripts

Hey, Andy.

Speaker A:Hey, Jed.

Speaker B:Great to see you.

Speaker A:Yeah, great to see you, too.

Speaker A:How's your summer treating you?

Speaker B:It's been good so far.

Speaker B:It's almost over, which is a bummer.

Speaker B:It's such a great time of year, but it's been good.

Speaker B:How about you?

Speaker B:And I want to hear how our special guests summer was as well.

Speaker A:Yeah, we got Shaka here.

Speaker A:Let's let.

Speaker A:Well, we'll introduce you right at the beginning.

Speaker A:Shaka, welcome.

Speaker A:We also have some business to do in terms of reminding people what this podcast is, but.

Speaker A:Shaka, welcome.

Speaker A:Nice to.

Speaker A:Nice to have you with us.

Speaker C:Thanks, Jed, Andy, good to see you both.

Speaker C:Yeah.

Speaker B:How's your summer been?

Speaker C:Yeah, summer's been good, but I will tell you, summer in Tennessee is very hot.

Speaker C:It is very humid.

Speaker C:Those of you on the west coast or the Northeast.

Speaker C:Yeah.

Speaker C:Appreciate what you have because it's been.

Speaker C:It's been rough, but school has started already in the Southeast, so my.

Speaker C:My kids are already in school.

Speaker B:Yeah.

Speaker B:It starts early down there.

Speaker B:Every.

Speaker B:Everybody's heading back.

Speaker B:It's in Virginia.

Speaker B:A lot of them are back.

Speaker B:The big count coming in this week.

Speaker B:And so, yeah, it does have that feel like summer is.

Speaker B:Summer is.

Speaker B:Is fleeting, but it's been hot.

Speaker B:It's been a real hot summer.

Speaker A:Hey, Andy, aren't you enjoying your first couple months of not being a state board member?

Speaker A:Yeah.

Speaker B:I mean, I was with you when we toasted my.

Speaker B:My return to civilian life and my freedom.

Speaker B:Yeah.

Speaker A:So how is it on the other side?

Speaker B:It's good.

Speaker B:I mean, look, you know, it.

Speaker B:The service part of it's great, but honestly, when sort of stuff comes up and you're like, well, I don't have to quite worry about that.

Speaker B:In the same way, there's.

Speaker B:There.

Speaker B:There's something liberating about that, for sure.

Speaker A:Well, it was.

Speaker A:It was great service there.

Speaker A:And I did go back after you had brought to my attention the fact that you guys approved those new accountability standards and all that stuff.

Speaker A:I actually poked around and looked at them, so seems like Virginia actually got some good work done while you were there.

Speaker A:We did.

Speaker B:We did that.

Speaker B:I think we made a real change, some important changes in our.

Speaker B:The quality of our history and social studies standards.

Speaker B:That's great.

Speaker B:The accountability system.

Speaker B:We open these lab schools, which we don't have a charter law really to speak of in Virginia.

Speaker B:I mean, technically there's one, but it's.

Speaker B:It's a fake one, but we open these lab schools or sort of partnerships with school districts and institutions of higher education, colleges, two Year colleges, four year colleges.

Speaker B:And they're really interesting around the state.

Speaker B:They're focusing on things like shipbuilding or, you know, Amazon web certifications or health professions.

Speaker B:And they're, you know, increasing options for kids.

Speaker B:And I'm hoping we can, that we can keep those.

Speaker B:They don't fall prey to sort of the political back and forth because it's not a full on school choice plan, but it's certainly a powerful step in the right direction, saying that a lot of families like.

Speaker B:So we built some cool stuff.

Speaker B:We'll see.

Speaker B:Politics.

Speaker B:As you guys may have heard, politics is pretty tough right now.

Speaker A:Pretty brutal.

Speaker A:Well, this is the Walkie Folk podcast.

Speaker A:I'm Jed Wallace and my partner in crime here is Andy Rotherham.

Speaker A:We've been doing this for quite a while.

Speaker A:Our last one, Andy, you know, with Stephen Wilson.

Speaker A:Yeah, I got a lot more emails on that than I've gotten on a lot of them.

Speaker A:I think it's a nice sweet spot for us when you got somebody that is both kind of with us and pushing us on our thinking at the same time is great.

Speaker A:And I think that Shaka is just another one of these examples.

Speaker A:Afc, everything going on, American Federation for Children, all that's going on with school choice.

Speaker A:There are all sorts of ways that we're like totally on the same team here.

Speaker A:There are other times when, wait a second, do we see things exactly the same?

Speaker A:So I'm really looking forward to today's conversation.

Speaker B:Yeah, I am too.

Speaker B:And one thing you can, we should mention, obviously you can get the podcast wherever you get podcasts if you like or subscribe.

Speaker B:That helps us and we appreciate it.

Speaker B:You can also suggest guests.

Speaker B:And so we get lots of great feedback.

Speaker B:And one of the pieces of feedback is, is suggest the kind of people either by type or by a specific person who, who, who you think would be good here.

Speaker B:So we can continue to, you know, have some guests on from time to time, because that's always fun for us.

Speaker B:Jed and I do get a little sick of each other after a while.

Speaker B:So, you know, you gotta.

Speaker B:Your variety is the spice of life.

Speaker A:That's an understatement.

Speaker A:But I mean, Shaka and I have had some email exchanges and, and I think that those exchanges have led to this conversation in addition to Andy, you and I just saying, wait a second.

Speaker A:This tax credit in the, in the, you know, one big beautiful bill actually has the likelihood of being a very seismic, very big change in public education.

Speaker A:So, Shaka, thanks for being here.

Speaker A:You know, American Federation for Children obviously played a big role in getting this whole thing done.

Speaker A:Before we get into the details of what this tax credit program looks like, would you mind walking our listeners through your own background?

Speaker A:And in particular, if you wouldn't mind, from my perspective, highlighting, you know, the fact that you've, you've really got bonafides in the charter school world as well that informs so much of what you're doing in your current role.

Speaker C:Yeah, for sure.

Speaker C:Thanks.

Speaker C:Thanks, Jed.

Speaker C:And I feel like I should tell you guys, like, oh, you know, longtime listener, first time caller, so thanks for, thanks for having me on and I'm glad to have this conversation with you both.

Speaker C:So, as you mentioned, I'm a senior fellow at the American Federation for Children, and probably your listeners know what AFC is about.

Speaker C:But just really quickly, you know, we like to say that we are kind of the nation's voice for school choice.

Speaker C:We push particularly hard in state houses.

Speaker C:In this case, we'll also be talking about U.S. congress.

Speaker C:But we, we push really hard for choice bills.

Speaker C:We just believe that every child deserves meaningful access to an education that best meets their needs.

Speaker C:And if that's public, great.

Speaker C:Glad that's working.

Speaker C:But we know it's not working for a lot of kids.

Speaker C:And so if it's a, you know, public charter, if it's a micro schools and private choice programs, we're pushing for those things.

Speaker C:We do a lot on the educational front as well.

Speaker C:So, yeah, happy to be with you guys in, in terms of, you know, how I kind of got into the work.

Speaker C:When I came out of grad school, I went up to D.C. as one who thinks they're interested in policy does.

Speaker C:I went to D.C. and I was working at a place called the center for Education Reform, which you both know.

Speaker C:And it's been a few years there.

Speaker C:And then I was at the Institute for Justice, and it's a, a constitutional law firm.

Speaker C:We were mostly, we sued the government, which I, I do have to say is pretty awesome work.

Speaker C:But when we weren't suing the government, we were representing families who wanted to participate in these in choice programs.

Speaker D:Right.

Speaker C: law passed and this is what,: Speaker C:So you get a law passed and immediately it's challenged in court.

Speaker C:And so we would intervene on behalf of families.

Speaker C:And that just I think, really kind of stoked the, the fire in me to, to really represent families and speak for families who otherwise didn't have an advocate, didn't have a champion.

Speaker D:Right.

Speaker C:And that I would say that's especially lower Income families, those who have been historically sort of disenfranchised.

Speaker C:And so yeah, I kind of wanted to be at that tip of the spear in pushing for education reform.

Speaker C:That time was a great time to be in D.C. because it was right when sort of the teeth for no Child Left behind were coming into, into, to force into full effect.

Speaker C: den we had this law passed in: Speaker C: By about: Speaker C:Now what do we do with it?

Speaker C:And so we were talking about this, you know, you had a whole range of reforms.

Speaker C:And so I kind of, I really came to that work in a way that I think wasn't as specific as it was directional, if that makes sense.

Speaker D:Right.

Speaker C:I like, let's push for reform, but, but we need to push on this thing from a lot of different angles.

Speaker C:And so it's going to be private choice.

Speaker C:Great.

Speaker C:It's going to be teacher performance pay.

Speaker C:Cool.

Speaker C:It's going to be district charter partnerships.

Speaker C:Okay, whatever.

Speaker C:And then when my wife and I moved to Tennessee again, we just, I wanted to continue that work.

Speaker C:And then I started to really put in time with a few charter management organizations, one local and then one national.

Speaker C:And, and that was great.

Speaker C:I mean, I hadn't been back into middle school since I was in middle school.

Speaker C:And so then I was working at a school.

Speaker C:We had one school, eventually grew to four.

Speaker C:Those included the first conversion schools in the state, the first achievement school district school in the state.

Speaker C:This was with lead public schools.

Speaker C:And that was just really good work.

Speaker C:So I saw school opening, school kind of, you know, school building level management and from time to time got in classrooms and you know, and subbed even.

Speaker C:And then I was with Rocketship and we open, helped Rocketship open three schools in, in Nashville.

Speaker C:And so again, it's just, it's really good work, Jed.

Speaker C:I think it's why you and I get along because, you know, we, I think we both believe that, you know, there's not one right way to do this.

Speaker C:There's going to be lots of different ways.

Speaker C:And, and if folks are doing good things for kids, then, you know, I'm all about it.

Speaker B:Before we jump in further, just you mentioned like you hadn't been to middle school since you were in middle school.

Speaker B:Just quickly, what was your own education like?

Speaker B:Like, where'd you, where'd you grow up and how was school for you?

Speaker B:Did you enjoy it?

Speaker B:Not enjoy it?

Speaker B:Like, what was that like?

Speaker C:Yeah, I, I did enjoy school.

Speaker C:I kind of, I blame this on my mother, who's not even five feet tall.

Speaker C:And I just tell folks, like, I had to enjoy school because I was obviously not going to the league, I was not gonna play ball or whatever.

Speaker C:But in seriousness, I grew up on Long island in New York.

Speaker C:The schools that we were zoned to were academically low performing, unsafe, chronically unsafe schools.

Speaker C:And so, so my parents, who worked for the postal Service, you know, saved with some help, sent my siblings and I to Catholic school.

Speaker C:And so we did that.

Speaker C:And then eventually, and so I always say, like, that's one former school choice paying for it.

Speaker C:The other former school choice we also took advantage of.

Speaker C:We moved from New York all the way to Georgia.

Speaker C:And then I went to public high school in Georgia also.

Speaker C:Really enjoyed that.

Speaker C:So again, I think it does inform me in that I go, oh, there's not one.

Speaker C:One right way.

Speaker C:You know, different models work for different kids.

Speaker C:And so let's see if we can unlock that for what, 55 million kids in the country.

Speaker A:Well, in terms of unlocking things, this tax credit embedded within the one big beautiful bill, I think is just starting to register across the reform world about just how profound this difference can be.

Speaker A:I'd like you to talk, if you, if you wouldn't mind, on, on in two ways, about the bill.

Speaker A:First of all, can you just educate our world?

Speaker A:What does it say?

Speaker A:How, what's the thumbnail that we're, we're being given on this?

Speaker A:And then if you could do a second pass, which is the mainstream focus is wrong or is underweighting a few things that we should be paying more attention to because it was, for me, learning in a few conversations, one of them with you, but several other people about some of those underappreciated things that really made me begin to understand this is a bigger change than, than I was first thinking.

Speaker C:Yeah, yeah.

Speaker C:So this, this federal tax credit program that passes, as you mentioned, as part of the, the one big beautiful bill.

Speaker C:It's funny, it does represent a really big deal, but in some ways it's not the big deal that you often hear about.

Speaker D:Right.

Speaker C:Because everybody says, or often in the media I've seen these headlines and they're like new federal voucher passes.

Speaker C:And I'm like, well, not exactly.

Speaker C:So let's talk about what it is.

Speaker C:All right, so it's a federal tax credit program that in some ways mirrors state level tax credit programs that we've had for years.

Speaker C:Right.

Speaker C:This has existed in, in a number of States, Arizona, Florida, Indiana.

Speaker C:For a while you had Pennsylvania, Illinois, et cetera, lots of these around the country.

Speaker C:But those have been regarding state level taxes.

Speaker C:So this is the first time in history that a taxpayer, three of us are taxpayers that a taxpayer can get a dollar for dollar tax credit off of federal taxes, federal tax liability.

Speaker C:If you instead now of putting money, sending money, your tax liability to the Department of Treasury, you direct it to a scholarship granting organization, now you will get that dollar for dollar credit, right?

Speaker C:So that's the taxpayer side.

Speaker C:And then the scholarship granting organization, the SGO can then give out scholarships.

Speaker C:And so it can give scholarships and, and those can be mission driven, right.

Speaker C:So you might have an SGO that says in my area we're going to give scholarships to students in Middle Tennessee.

Speaker C:And so those, that maybe that's going to be some of the criteria.

Speaker C:But the scholarships, the dollars themselves can be used to cover a range of educational expenses.

Speaker C:So the, the use is much more like an education savings account.

Speaker D:Right.

Speaker C:The administration of it is, is more like a, a tax credit scholarship, a tuition, you know, scholarship.

Speaker C:That's really the gist of it in terms of how much of a credit you can get right now it's $1,700 per taxpayer.

Speaker C:So that's how much you can put into it.

Speaker C:The scholarship granting organizations will make their own decisions about the size of the scholarships and then in terms of who's eligible from a family standpoint, it is for most students are eligible, but there is an income limitation.

Speaker C:And that income limitation I believe is 300% of the median area income.

Speaker C:So now we're getting really wonky.

Speaker C:But, but there is a, a slight income limitation on who, on which families can use it.

Speaker C:So that's, that's the gist of it.

Speaker B:And what can you use it for?

Speaker C:Yeah, yeah, great question.

Speaker C:In terms of what you can use it for, you can use it for the same thing.

Speaker C:If people, some people may be familiar with the Coverdell Scholarship, right.

Speaker C:Or Coverdell expenses.

Speaker C:And so you can use it for any of those qualified educational expenses.

Speaker C:So this would be things like tuition and fees at a school, books, tutoring, other educational supplies.

Speaker C:If, if there's a student with special needs, you could use it for special needs services, could use it for room, board, it's really educational expenses.

Speaker C:Some, some materials and technology might be included in that.

Speaker C:So it's pretty broad in terms of how you could use it.

Speaker C:So not just tuition is the, is the key.

Speaker A:So can you walk me through some of the details about how a tax credit program like this gets implemented because I'm not from a state where there is a state program like this.

Speaker A:So as I understand it, this could be described to me incorrectly.

Speaker A: ing to really start until the: Speaker C:2027.

Speaker D:Yep.

Speaker A:And so the funding will really start flowing thereafter.

Speaker A:Presumably 28 school year.

Speaker A:But you as a tax.

Speaker C:27.

Speaker C:28 school.

Speaker C:I would, I would expect it to start.

Speaker C:27.

Speaker C:Yeah.

Speaker A:Okay, so then you as a taxpayer, you have to decide, okay, yes, I want to take advantage of this tax credit.

Speaker A:And then you have to identify the specific SGO you want the funding directed to.

Speaker C:Correct.

Speaker A:So if I'm going to TurboTax, you know, and I want this thing to happen now, presumably people are going to be reaching out to TurboTax and saying, okay, there's this new funding, there's this new tax credit program.

Speaker A:Hey TurboTax, make a drop down window.

Speaker A:Let me get to my state, let me get to my.

Speaker A:But somehow 100.

Speaker A:You've got to direct it down to the specific SGO level, right?

Speaker C:Correct, correct.

Speaker A:And then the SGO will have different things that it could be supporting.

Speaker A:But let's say we want to subsidize private schooling.

Speaker A:Well, private school would be able to say, hey, here's the percentage of students and maybe the names of the students.

Speaker A:I don't know if it's, if that's required, that actually fall below that 300%, you know, income level.

Speaker A:All of those students potentially could be recipients of a seventeen hundred dollar benefit if enough money flows into an SGO that's got the mission to fund those kinds of schools.

Speaker A:Is that a good summary?

Speaker A:Am I missing here?

Speaker C:Yeah, almost.

Speaker C:Okay, so most of that, most of that is right.

Speaker C: little bit so that first the $: Speaker C: So if the three of us put in $: Speaker C:I should not have done that.

Speaker C:But we're gonna.

Speaker C:What's that work out to?

Speaker C:5,100 bucks.

Speaker C:There's three of us.

Speaker C: so we put in, we each put in $: Speaker C:Well, let's just say that we want it to go to a scholarship granting organization in Nebraska which none of us are from.

Speaker C:But we picked the, we picked the exact middle of the United States.

Speaker C:And so we said Nebraska.

Speaker C:We direct it to Nebraska.

Speaker C:The Nebraska SGO might give scholarships worth $5,000.

Speaker C:So SGO.

Speaker C:So that scholarship amount, that dollar amount that families receive is not tied to the seventeen hundred dollar amount.

Speaker C:That's, that's on the taxpayer side.

Speaker C:Okay.

Speaker C:So there's going to be some decisions to make, which also means that different SGOs are going to have.

Speaker C:They're going to make different decisions.

Speaker D:Right.

Speaker C:Some are going to have them be much more limited.

Speaker C:It might be kind of last dollar style.

Speaker C:Some might be, you know, bigger, bigger tuition grants or whatever.

Speaker C:Grants that go out, not just tuition.

Speaker B:Well, yeah, we'll talk about that.

Speaker B:What is the whatever?

Speaker B:So what if you want to have an sgo, you want, you want to do tutoring or you want to do something that services homeschool students or like.

Speaker B:Yeah, like, I mean, what are the.

Speaker B:What are the limits?

Speaker B:What can and can't SSHO's orient themselves towards?

Speaker C:Yeah, this is, this is going to be a good question.

Speaker C:So the rules have not been promulgated yet.

Speaker C:So that's got to give that pretty sizable disclaimer.

Speaker A:A lot of rules to be.

Speaker A:Yeah, a lot of rule.

Speaker C:A lot of rules to be made.

Speaker C:Well, and frankly, it's just.

Speaker C:It's complicated because it's happening at the federal level.

Speaker C:Right.

Speaker C:So we saw how complicated it was to get this thing passed.

Speaker C:You know, there will be lots of voices that want to be heard during the rulemaking process.

Speaker C:So a little bit, Andy, TBD on.

Speaker C:On how specific an SGO can get.

Speaker C:Now, per the language in the law, there are a few things in.

Speaker C:One of them relates back to Jed's example.

Speaker C:An SGO can't be affiliated with a single school.

Speaker A:Oh, it's.

Speaker C:No.

Speaker C:So that's interesting.

Speaker A:Okay.

Speaker C:Yeah.

Speaker C:So SGOs have to give out.

Speaker C:They do.

Speaker C:There are some rules just baked right into the law.

Speaker C:So for instance, they've got to give out 90% of their revenue.

Speaker C:But this also means you can't just start up or you can't just like say, well, we're now accepting tax credits for our existing nonprofit.

Speaker C:I mean, you, you maybe could do that, but you're going to have to start sending 90% of your revenue out the door in scholarships.

Speaker C:That doesn't work for most nonprofits.

Speaker D:Right.

Speaker C:So it actually is going to benefit SGOs to have some.

Speaker C:To get some scale, benefit and work across lots of schools or lots of people, maybe even partner, you know, with other organizations.

Speaker C:So that's one piece.

Speaker C:So SGOs have to.

Speaker C:They have to benefit students who attend at least two schools and at least 10 students.

Speaker C:You also cannot direct.

Speaker C:You can't just pick out.

Speaker C:I Would love for you if you want to just support the Mitchell girls, I would love that.

Speaker C:But you're gonna have to just send a check directly to me and you're not going to get a tax write off for it.

Speaker B:We'll put that address in the show notes.

Speaker C:Yeah, we'll put it in the show notes.

Speaker C:Yeah.

Speaker C:And I promise I'll claim it as, as income if the IRS is listening.

Speaker A:So not an individual school, but what about a school district?

Speaker A:Yeah, we're gonna, we're gonna create an SGO for.

Speaker A:I live in Davis, Davis Public Schools.

Speaker A:Is, is that going to be permissible?

Speaker C:That, that will probably be permissible, but.

Speaker C:And I think we're going to get to this.

Speaker C:What's probably not going to be permissible is for the decision makers here, and this is a piece we haven't talked about yet.

Speaker C:But for governors who are the ones who actually have opt into this program, it's probably not going to be permissible that they can get too cute and pick and choose based on some of those underlying, you know, use cases.

Speaker A:Okay, I want to get to that because the governor dynamics here in the process for approval and what, what is within governor's purview and what needs to come from the legislature fast.

Speaker A:But, but before we get there.

Speaker A:So it just seems to me as any place where we have opted in and if there is a school, school district eligibility, there is going to be massive outreach.

Speaker A:Massive outreach to everybody.

Speaker A: Hey, you can all direct: Speaker A:We'll make sure it gets back to your school.

Speaker A:It's going to be for such and such a purpose.

Speaker A:Just the massive marketing to try to get those taxpayers to choose the right dropdown menu.

Speaker A:Seems to me like ocean that we're sailing into here soon.

Speaker C:Yeah, I mean I can, I can see how that could be possible, but there is the, there are a few things at play.

Speaker C:For instance, again, these are funds that are going to families.

Speaker C:So it's a little bit challenging to imagine a use case for a public school district or for most public school districts.

Speaker C:I'm thinking about the one where I live which is not terribly innovative.

Speaker C:I don't know that our district could put something together for fast enough, put offerings together fast enough that would require payments such that families would need a third party scholarship to access those services, if that makes sense.

Speaker C:Okay.

Speaker D:Right.

Speaker C:So.

Speaker C:So here, here would be a, a different, different use case because tuition is easy.

Speaker C:Like people understand that you got to pay for it.

Speaker C:Tutoring even is easy.

Speaker C:And, and somebody's Got to pay for the tutoring.

Speaker C:But what in a public school district is extra that you're required to pay for that?

Speaker C:You would say, oh, I need a five thousand dollar scholarship for right now.

Speaker C:Now a family could still apply to an sgo, but the family, but again, the family is the decision maker.

Speaker C:And so that's where I think districts are going to get probably a little squeamish because they can't control it.

Speaker D:Right.

Speaker C:If I'm a family and I've got a kid in the district, well, if I get that scholarship, I have to use it for educational expenses, but I don't have to use it for educational expenses in my district.

Speaker C:That makes sense.

Speaker C:So that, that's where it's going to.

Speaker C:You know, there's some unknowns here, but I do want to say one point and that is students are basically eligible for this regardless of the type of school they attend.

Speaker C:And so that's really important too.

Speaker C:And I think that gets missed a lot because if you read the headline that says, oh, it's a, it's a federal voucher program, well, that, that means one thing, very specific thing in a very specific private school context.

Speaker C:The fact that you could have a student with exceptional needs attending a charter school and they could apply for a scholarship and they could use some of those funds for some supplemental services, some additional tutoring, et cetera.

Speaker C:That's pretty new.

Speaker C:And, and I think a lot of people miss that.

Speaker A:Andy, let me shut up here because my cynicism about how traditional public school schools take on their economics is going to be insufferable.

Speaker A:Go ahead, ask a few additional questions that maybe from a school board perspective from Virginia or wherever might be occurring to you.

Speaker B:Well, the behavioral stuff here is going to be interesting and states like Virginia will be interesting, which Virginia is a state that's very likely to have a Democratic governor come January and there's going to be a lot of cross pressure on Democratic governors what to do about this because you hear people are saying it's free money on the table and so you should take it.

Speaker B:But it's obviously got some of the choice baggage.

Speaker B:We should talk about all that before.

Speaker C:We get to that.

Speaker B:You mentioned the Coverdell program and I can remember when that was.

Speaker B:So that was Senator Paul Coverdell of Georgia and it was sort of an education Savings account for K12 expenses.

Speaker B:It was essentially like an expansion of the 529 idea.

Speaker B:But.

Speaker B:And it was for K12.

Speaker B:It was very controversial and much more modest than this.

Speaker B:And I don't know, I Mean, you were closer, I suspect, to like all the lobbying around this and everything.

Speaker B:But I was struck.

Speaker B:This does seem consequential.

Speaker B:Marguerite Rosa, the school finance expert, she estimates this will generate about 28 billion in activity.

Speaker B:Like, this is a consequential thing for K12 schools.

Speaker B:And yet, I don't know, it seemed like the fight was just not like we've had much smaller school choice programs that have just been absolutely scorched earth battles on Capitol Hill and this.

Speaker B:And so like, I wanted to hear your reaction to that.

Speaker B:It's just.

Speaker B:Have the politics changed?

Speaker B:Was it just the unique structure of this bill?

Speaker B:Was it just the unique moment we're in that, you know, with, with everything going on in that bill.

Speaker B:But it just didn't seem like a typical school choice fight.

Speaker C:Well, let me say this.

Speaker C:I think it was.

Speaker C:That just means that the folks who were engaged were doing their level best to make it, you know, look like a duck, right.

Speaker C:And so smooth on top, but paddle, paddle, paddle, kick, kick, kick underneath the surface.

Speaker C:It was really churning underneath.

Speaker C:And so this thing in the final week was all over the place in terms of the content, in terms of whether it was even in, I mean, this is, some of that was the.

Speaker B:Parliamentarian, right, with the Senate, whether it would comport with the rules.

Speaker C:Correct, Correct.

Speaker C:Yeah.

Speaker C:So, so there were definitely, you know, as you said earlier, turns out politics is, is tough.

Speaker C:Politics is, is really messy.

Speaker D:Right.

Speaker C:And this got very political.

Speaker C:So hats off to all the advocates who, who jumped in and, and supported and invest in Ed was really big on this AFC others.

Speaker C:But I, but something that I do think was different is that this was, this was discussed among senators and members of the House last year.

Speaker C:So it's been like a year of talking about really some specific language, not to mention the, you know, depending upon who's counting the 15 or 20 years that, that people have kind of sent up some trial balloons on, hey, what about a federal, some kind of federal choice program?

Speaker C:But I think when you, my sense is that when you get some specific language out there early, you can, you start to build consensus, you start to workshop it, you start to get buy in.

Speaker C:I know a lot, there are a lot of advocates, I think, who want to keep everything super close to the vest until the last minute.

Speaker C:But I believe that the risk in doing that is that then you don't, you don't know where your flaws are and you don't know what's going to derail you.

Speaker C:And so put, you know, we put something out there.

Speaker C:We know Some people are going to hate it.

Speaker C:All right, cool, fine.

Speaker C:But what about the ones who are close?

Speaker C:How do we get them to yes?

Speaker C:And I think we had enough time to kind of get folks to yes and yeah, got it across the line.

Speaker C:And by the way, we're still going to see how things shake out with both rules, though.

Speaker C:I'm encouraged about that process.

Speaker C:And then in future years, because, you know, as you mentioned, Coverdell kind of went through its sort of debate process, but you don't really hear anything about it anymore.

Speaker D:Right.

Speaker C:Nobody talks about it.

Speaker C:It's like we pass these things and it's like, okay, well now it's just part of the code is what it is.

Speaker C:So I'll be curious to see how this changes, expands, etc over time.

Speaker B:And one real technical question.

Speaker B:Who issues the regulations for this?

Speaker B:I, I don't know the answer to that.

Speaker B:Is it going to be treasury or is it going to be education?

Speaker C:Treasury.

Speaker B:Treasury, yeah.

Speaker A:Well, I love that, the storytelling about, hey, we need to have enough engagement with a bunch of policymakers and have broad support.

Speaker A:And as far as the OBB goes, there were two groups that were important, either people that were willing to stop the whole darn bill over their pet project.

Speaker A:And it doesn't sound to me like there was anybody that was in that camp, nor do I know anybody that was saying, I won't vote for it unless it's in there.

Speaker A:So without it being there, then it defaults back to the president wanted it.

Speaker A:Trump wanted it.

Speaker C:Yeah, he did.

Speaker A:And he said he wanted it, that that's what happened.

Speaker A:Now then, then there get to be the parliamentary details.

Speaker A:Is this going to be 17, hey, can we allow a $2 million, you know, tax deduction for our high taxpayers?

Speaker A:And those details, you know, rippled out thereafter.

Speaker B:He's not talking about it, though.

Speaker B:I mean, you say he wants it, but like, I don't know, shock have I been missing?

Speaker B:I just haven't heard him talk about this.

Speaker C:No, no.

Speaker B:I mean, in niche conservative media or something, but it's just not like in any of the broader communications he's doing.

Speaker B:I haven't heard any discussion of this.

Speaker B:Have you?

Speaker C:Yeah, yeah.

Speaker C:No, I mean, I think, respectfully, I think the President's been a little busy with other things in the, in the past month.

Speaker D:Right.

Speaker C:But no, I, I'll tell you, Senator Cruz was big, so you had to talk about like agreeing on that.

Speaker C:Who was sort of willing to kind of lay across the tracks.

Speaker C:Cruz was and did for this, you know, in the House side, which was Less contentious.

Speaker C:You know, Byron Donalds was really big on this.

Speaker C:But you know, Senator Cruz and then the speaker, you know, the Senate President, super important on this.

Speaker A:Well, as I understand it, where Cruz was really focused was make sure the President at some point in the process makes it clear to his staff that this is something that he values and that in fact did happen.

Speaker A:And so it kind of.

Speaker A:But whatever these are the political dynamics, I don't think that really makes any difference in terms of the substance of the thing.

Speaker A:This is just how the darn thing got done.

Speaker A:I think.

Speaker A:One question I have, I'm fascinated by.

Speaker A:I had not seen that Marguerite has estimated 28 billion and so my case.

Speaker B:7, 28, something like that.

Speaker B:Don't hold me to it.

Speaker B:We'll throw in the show notes, I'll find the thing that you put out.

Speaker A:So I was wondering, Shaka, has AFC done any estimates or is this just so unprecedented?

Speaker A:Who the heck knows?

Speaker A:It's, I mean it would seem to be as though it's going to be significantly higher than 28 billion, but I don't know.

Speaker C:Yeah, this is one of those where it's just really hard to get a, a good line on this.

Speaker C:I mean I think the number will be quite large.

Speaker C:It certainly has the potential to be quite large.

Speaker D:Right.

Speaker C:Because any taxpayer, anybody with federal tax liability in the country can participate.

Speaker C:So turns out there's a lot of us.

Speaker C:But you need a few things.

Speaker C:You've got to have scholarship granting organizations, right?

Speaker C:Yep.

Speaker C:There's, there's got to be some kind of education slash marketing campaign that's happening so that people know about this.

Speaker C:And as you mentioned.

Speaker C:Yeah.

Speaker C:I would love for TurboTax the next time I log on for there to be a drop down and I select the ones in my state.

Speaker D:Right.

Speaker C:Or whatever, select the ones in a different state because that's something that you can do.

Speaker C:And I think I'll come back to.

Speaker C:But it's really hard to say.

Speaker C:I mean when there was a number in the legislation, in the draft legislation, I guess it wasn't even draft at this point.

Speaker C:You know, the number oscillated between 20 billion 10 billion, a cap of 20 billion 10 billion 4 billion.

Speaker C:It was, it was all over the place.

Speaker C:And then next thing you know we got this no cap, but a seventeen hundred dollar per taxpayer cap.

Speaker C:And so if there's a tricky part, that's going to be the tricky part because to get to 26, 27, 28 billion like you know, Marguerite suggests, that's a lot of seventeen hundred Dollar contributions.

Speaker D:Right.

Speaker C:None of us knows.

Speaker B:None of us knows that development first 15,000.

Speaker B:But don't again, don't hold me to that.

Speaker B:It's all taxpayer.

Speaker B:It's maxing out.

Speaker C:Oh no, I think it's more than that.

Speaker B:Okay.

Speaker B:I'm doing the math in my head.

Speaker C:Yeah.

Speaker C:To get to the billion number.

Speaker C:I think you're right.

Speaker B:That would be million.

Speaker B:Yes.

Speaker B:It'd be 100.

Speaker B:It would be 160.

Speaker B:Sorry, no, no one came here.

Speaker B:Watch us do mental math.

Speaker C:But, but again like so that's, that's going to get tricky.

Speaker D:Right.

Speaker C:To raise that kind of money in what you might call in some ways like small dollar donations.

Speaker C:It'd be much easier if you could go to high net worth individuals and say hey, can you direct 10% of your tax liability over there?

Speaker C:10% of you know, for high net worth is, is a whole lot of folks.

Speaker C:So.

Speaker B:You'Ve done this for a while.

Speaker B:Just.

Speaker B:And I mean there have been like opportunities for like corporate, with corporate tax, with personal tax in states to fund these things.

Speaker B:Are there any sort of lessons you've learned from that or things to things to watch for?

Speaker C:Yeah, good question.

Speaker C:I mean we have seen these, seen many of these programs at the state level.

Speaker C:I think the marketing after the fact is always really important.

Speaker C:You want to.

Speaker C:And I talked to other just colleagues in the space about this sometimes maybe apropos of Wonky Folk, the name of this podcast, but sometimes we want to talk to people and we want to tell them like, oh, let me tell you all of the market driven competitive effects of this program.

Speaker C:Okay.

Speaker C:That is not what normal people want to talk about.

Speaker D:Right.

Speaker C:They want to go, oh, I can get $5,000 and I can use it to improve education for this child this year.

Speaker C:Okay, now we're talking about something tangible.

Speaker C:So I always think translating it to, to the, the person kind of the end user in this case families is really important.

Speaker C:You know, also with this and let's.

Speaker C:I think we should speak about this.

Speaker C:We don't want states to try to get again too cute and think that they need to do a whole lot.

Speaker C:They actually don't need to do a lot about this program.

Speaker C:This is a federal tax credit program.

Speaker C:Governors are governors must opt in.

Speaker C:It says actually governors or what other entity in a state makes such elections regarding federal tax benefits.

Speaker C:So a governor's most of the time that's going to be governors.

Speaker C:We're going to see North Carolina is doing some interesting things where the legislature has basically said hey, we want to opt In.

Speaker C:So governors need to opt in.

Speaker C:They don't actually need to do a whole lot.

Speaker C:The statute lays out how the money can be used, who's eligible, what an SGO needs to do to qualify.

Speaker C:So governors don't really need to do a whole lot.

Speaker C:So this then is the question, what's kind of going to become, I think maybe a wedge issue, Jed, for blue state governors.

Speaker D:Right.

Speaker C:Is what are they going to do?

Speaker C:And, yeah, let's talk about that.

Speaker B:That's.

Speaker B:We wanted to hear.

Speaker B:How do you see that playing out?

Speaker B:Because it does.

Speaker B:And you're already starting to see some.

Speaker B:North Carolina made a move just this week when we're.

Speaker B:When we're filming this, to give the government.

Speaker B:So the governor is going to have some flexibility there.

Speaker B:What he does.

Speaker B:Like, how do you see that playing out in different blue states that way?

Speaker C:Yeah, yeah.

Speaker C:So.

Speaker C:So North Carolina is interesting.

Speaker C:You have a Republican majority in the, in the General Assembly.

Speaker C:They have passed a law saying that they're going to participate, that they want to participate.

Speaker C:And then you have the governor saying he's a Democrat, saying, well, I want to participate, but he's sort of trying to.

Speaker C:Trying to have one foot in, one foot out a little bit.

Speaker C:I want to participate.

Speaker C:But what if we only direct it towards SGOs that.

Speaker C:That are directed towards public school, conventional.

Speaker A:Public school district funding enrichment exercises happening in traditional public schools.

Speaker C:Correct, Correct.

Speaker C:And I think that's not going to be allowed, actually.

Speaker C:I don't think governors are going to be able to pick and choose.

Speaker C:I think it's going to be a sort of all or Nothing.

Speaker C:Like if SGOs come and they meet the, the qualifications which are again, laid out in statute, I think a governor is going to have to go, like, all right, basically, here's the slate.

Speaker C:And some of those might be Catholic schools, SGOs.

Speaker C:Right.

Speaker C:Or diocesan SGOs.

Speaker C:Some might be based on whatever it's eastern North Carolina.

Speaker C:Some might be, you know, all right, this is going to be the Charlotte Mecklenburg SGO that pops up.

Speaker C:Okay.

Speaker C:But if they all hit the, like, check the boxes, I think it's going to have to be all or nothing.

Speaker C:And if it's nothing, then this is where it gets really interesting.

Speaker C:Because, you know, Jed, in your state, in California, you've got a lot of taxpayers.

Speaker C:Well, every taxpayer can contribute to an sgo.

Speaker C:The question then for the, for the governor of California, you know, if you ever elect another one again, I, I don't know who's running?

Speaker C:Nobody.

Speaker C:Nobody and everybody.

Speaker C:But the question for a governor of California is Going to be.

Speaker C:Well, if we don't participate, where are we potentially exporting all those dollars?

Speaker C:Yeah, right.

Speaker C:Because again, people can.

Speaker C: , in LA can get a dollar for $: Speaker C:So, you know, that's, that's billion.

Speaker C:That's a billion dollars right there.

Speaker C:If California says, no, we don't want to participate, but the taxpayers still access TurboTax and they've got the drop down like everybody else.

Speaker A:Yeah, well, you're.

Speaker A:We're talking about, Marguerite, at 28, 30 billion, whatever that is.

Speaker A:That's getting close to between a third and a fourth of the entire state budget for public education in California.

Speaker A:So these are huge numbers.

Speaker C:Big numbers.

Speaker A:Shaka, I've heard, I've read several columns about this is going to be in private school tuition assistance or whatever, some additional thing that, that can be made available for in a private school context and in the public school context.

Speaker A:It's going to be enrichment.

Speaker A:It's going to be enrichment.

Speaker A:What.

Speaker A:Now what I think you're saying is if you, if a state opts in, then SGOs of all different kinds can get into the landscape.

Speaker A:Some of them may be public school enrichment activities and others may be private school.

Speaker A:But you're saying that the governor, from a state law standpoint, is not going to be able to prevent one or the other from being the only option that's available for taxpayers choosing.

Speaker C:I think that's right.

Speaker C:I mean, again, the rules have to be promulgated, so, you know, we're going to see.

Speaker C:But yeah, I think that's going to be the case.

Speaker C:I don't think.

Speaker C:I mean, you know, and also think about the legal implications here.

Speaker C:If a governor said, I've got two applications for SGOs in front of me.

Speaker C:One is for Oakland, you know, Oakland public schools or supporting Oakland public school students is how it would be.

Speaker C:The other one is supporting diocesan schools in Oakland.

Speaker C:Well, you can have some real problems if both of those.

Speaker C:Check all the boxes and you say no to one.

Speaker C:That, I mean, that sounds like a, a First Amendment problem.

Speaker C:The Supreme Court would love that case right now.

Speaker B:Well, especially you've got, also politically, you've got blue state, a fair amount of penetration of parochial schools, for instance, where politically that would be a difficult position.

Speaker A:Am I remembering right that Shapiro said he'll sign as long as the legislature brings him something saying to sign.

Speaker A:Is that.

Speaker A:Am I remembering right?

Speaker C:Yeah, that sounds, that sounds right.

Speaker C:I don't know if he said that.

Speaker C:About this or about the, it might have been about, about this.

Speaker C:I know, you know, he's, I think that he had, he signaled that he's open to taking the next step.

Speaker C:And you know, again, it's a, that's an interesting kind of purple dynamic in Pennsylvania.

Speaker A:Is there any blue state gov that has said, I'm in, I'm signing.

Speaker A:I'm not aware of one.

Speaker C:If there is one, I'm not aware of one.

Speaker C:But I am aware of in many that have got their policy people kind of behind the scenes asking questions and investigating how do we do this?

Speaker C:Because again, it's a, it's going to be hard to tell families, hey, we're not participating in this thing.

Speaker C:We're, we're going to, our state is not going to offer, is not going to make scholarships available to kids within the state.

Speaker C:That's, that's just going to be a tough thing to have to say.

Speaker B:You know what it reminds me a lot of is casino gambling where like the biggest predictor whether or not it spread was whether your neighboring states had it.

Speaker B:And so you had the states that were like, not necessarily enthusiastic about embracing gambling.

Speaker B:But we're not, we're even less enthusiastic about watching money, you know, basically flow to the next state.

Speaker B:And that's going to be a very compelling.

Speaker B:The national nature of this will create some dynamics that we haven't seen most until now.

Speaker B:These choice fights have been state by state, but this nationalizes it in a way because to your point, taxpayers can participate elsewhere.

Speaker B:And so it's going to be hard to explain why you're sending this money from your state elsewhere.

Speaker C:Yeah.

Speaker C:And especially when it's not coming out of your state coffers.

Speaker D:Right.

Speaker C:Like, this is not, this is different from a, from a state based choice program where you often hear opponents would say, well, you know, if you're going to have that choice program, why not just not have the choice program and do a bigger appropriation and send all the money into the existing public schools?

Speaker C:Well, this is different.

Speaker C:It's sort of, you can participate in the program, but there's not a counterfactual where you, where you just get this money.

Speaker A:So, Andy, where do you think, where do you think the unions come down on this?

Speaker A:It just seems to me as though a lot of them, a lot of them, if you're CPS or you're, I mean, CTU or UTLA, you're thinking, wait a second, okay, 400,000 kids in Los Angeles, okay, this is a, this is a ton of freaking money.

Speaker A:Ton of fricking money.

Speaker A:We're going to be able to convince most of people in Los Angeles to put it into someplace that it will end up benefiting us.

Speaker A:And what's the ancillary, you know, negative we got to put up with?

Speaker A:Oh, a few.

Speaker A:A few private schools in.

Speaker A:In California are going to get some bin.

Speaker A:I wouldn't be surprised if a lot of them are not going to make this a total line of the sand issue for.

Speaker A:For governors.

Speaker B:Well, I think Shaka's point also is we got to wait to see how the rules come in and how much it forces their hand or not.

Speaker B:If it's a thing where.

Speaker B:If it's a situation where you're Gonna have different SGOs competing to offer different kinds of models, then they may decide they can.

Speaker B:They can play in that market.

Speaker B:So I think.

Speaker B:I think we have to wait to see the rules.

Speaker B:I was.

Speaker B:And I think it may just be because there was so much stuff going on in that bill overall, and some really consequential stuff.

Speaker B:I know, Jed, you.

Speaker B:You.

Speaker B:You're calling it the one beautiful bill because you're very maga.

Speaker B:But I don't really.

Speaker B:I don't really like the bill very much.

Speaker B:There was so much stuff going on that they were preoccupied, but I just didn't see the bite out of them that I've seen on some other.

Speaker B:On.

Speaker B:On some other stuff.

Speaker B:Shaq, what I want to hear from you is, is okay, you got the choice.

Speaker B:Crowd is riding really high on this.

Speaker B:It's a huge win.

Speaker B:Unprecedented.

Speaker B:But what, what keeps you up at night?

Speaker B:Like, there's always, you know, there's always the stuff that pe.

Speaker B:You know, people actually worry about that could.

Speaker B:Could.

Speaker B:Could become a problem.

Speaker B:What, what keeps you up at night?

Speaker C:Yeah.

Speaker B:Are you.

Speaker C:Are you thinking specifically about the federal piece or just generally what's.

Speaker B:As it gets implemented?

Speaker B:Like, what's.

Speaker B:The things that no one's.

Speaker B: t that is going to blow up in: Speaker C:Well, I don't.

Speaker C:I don't know that it's going to.

Speaker B:Stuff like that on every, on every issue.

Speaker B:What do you, what do you worry about with implementation that could.

Speaker B:That could cause problems or headwinds for this down the road?

Speaker C:Yeah.

Speaker C:Yeah.

Speaker C:It's a good question.

Speaker C:I mean, I don't.

Speaker C:I don't know that I don't have any reason to think that these are going to become catastrophic.

Speaker C:However, there are a lot of states that don't have experience with a state based tuition tax credit program.

Speaker D:Right.

Speaker C:So if you're, if you are Arizona, well there's already a bunch of SGOs that exist.

Speaker C:There's some muscle memory there both in terms of how you, how you get the dollars, how you dole them out, all that stuff.

Speaker C:If, if you are, you know, if you're, I mean Tennessee, we don't have a tax credit program.

Speaker C:We've got other private choice programs now.

Speaker C:But this is a little bit different.

Speaker C:Um, we've seen in Missouri.

Speaker C:Missouri has a tax credit funded ESA program.

Speaker C:And what we found is that's really tricky.

Speaker C:It's tricky to raise those dollars.

Speaker C:You know it turns out that a lot of people who have tax liability already have strategies to direct their tax liability to other organizations.

Speaker C:Right.

Speaker C:So it's not just like everybody is just cuts the check directly to the irs.

Speaker C:A lot of people already write checks to other, other places now.

Speaker C:This might be worth a little more.

Speaker C:So there's some of that SGO infrastructure that's kind of, that's what I'm thinking a lot about.

Speaker C:I also don't love the, the annual opt in nature of this could be really disruptive in election years.

Speaker C:So a governor has to opt in to this program on an annual basis.

Speaker C:That's not a big deal.

Speaker C:In my state in Tennessee, Andy, in your state in Virginia where you've got both term limits and it's such from governor to governor, it's Republican, it's Democrat, bounces back and forth that could cause real disruption if we're not careful.

Speaker C:So that's something I'm thinking about too Shock.

Speaker A:I don't think we'll have enough time to talk about how AFC is kind of unique in the broader private school choice landscape.

Speaker A:You and I talked a little bit about that.

Speaker A:Maybe we can touch upon it before we go.

Speaker A:We're kind of getting low on time here.

Speaker A:But one thing in front of that, that, because I think that's just fascinating what's going on with Universal and how are we keeping our thumbs on the scale for low income kids?

Speaker A:And I think AFC has been distinguishing itself from, from some of the others.

Speaker A:I think this is a really important thing for our world to know.

Speaker A:But can you speak to charter schools specifically and, and this bill and what you think some of the benefits are to the charter school movement if we're proactive enough and, and play our cards right here?

Speaker C:Yeah, yeah.

Speaker C:And, and I would love to come back at some point if you, you know if, if the people want it and we can talk more about that because I do think we, we care a lot about low income families and prioritizing them in choice programs.

Speaker C:And we, you know, been able to get that passed and get that baked into some state programs as regards charter schools.

Speaker C:And I mentioned that, you know, I've got a good deal of experience in the charter sector.

Speaker C:I really think that the federal tax credit program is one of these things that can inject some or, or spur on, I guess, some innovation back into the charter space.

Speaker C:And I say that respectfully.

Speaker C:I know that there are charters doing innovative things, but I also know that there are a lot of charters, I would say too many charters who, you know, said like adding 30 minutes of instructional time, like that's what counts as innovation.

Speaker C:And I would just sort of say like, maybe not.

Speaker C:I think we can do more, I think we can do better.

Speaker C:And this is going to be the kind of program that really innovative school leaders get.

Speaker C:It gets their wheel spinning.

Speaker D:Right.

Speaker C:So for instance, I know of a, I can't say which one, but I know of a CMO in, in Texas that already has got a reputation for providing really good college counseling services for its students.

Speaker C:Well, it could provide those services for other kids in the community.

Speaker A:Right.

Speaker C:Those kids might be in, in the existing public school district, they might be homeschool students, whatever that.

Speaker C:I think that's a win for kids.

Speaker D:Right.

Speaker C:And so if, if families could get those funds could then go to charters for some of these a la carte services.

Speaker C:Maybe it's a, you know, an AP course, right?

Speaker C:That, that happens in the summertime.

Speaker C:Maybe it's, as I mentioned, college counseling.

Speaker C:Who knows what?

Speaker C:I think there's going to be some cool ways to innovate for the leaders that appreciate that if they're worried so much about private choice as some are.

Speaker C:Okay, cool, you can, you can sit it out, but it's happening regardless.

Speaker A:Is AFC itself going to become an sgo?

Speaker C:That's a good question.

Speaker C:That's above my pay grade.

Speaker C:You know, I think again, I mentioned that you'd have to, you'd have to send 90% of your revenue, would have to go out the door in scholarships.

Speaker C:And so I, I suspect that would mean all of us taking a major pay cut to make those numbers.

Speaker A:It's not 90% of the tax revenues, it's 90% of the aggregate revenues of the organization.

Speaker C:The organization's revenue.

Speaker C:Yeah, yeah.

Speaker C:No.

Speaker C:Now that, that being said, are related entities going to, going to crop up?

Speaker C:Yes, because you're going to have, as I mentioned, you're going to have a diocesan SGO that pops up.

Speaker C:Does that mean that all of the revenue of the Catholic Church goes to this?

Speaker C:No, of course not.

Speaker D:Right.

Speaker C:It's going to be a separate 501C3 entity.

Speaker C:So these are going to start, but they do have to be state based.

Speaker C:And so that, that is a.

Speaker C:Is something that I think we're going to have to keep an eye on.

Speaker C:More will come out in the rules as well.

Speaker C:But I don't think you're going to, it's not going to be a situation where you have one SGO to rule them all.

Speaker A:It's.

Speaker C:You're going to have a lot of these in the states.

Speaker B:And I think you're.

Speaker B:The point you made earlier a moment ago about infrastructure I think is just really important that we're having just this just absolute sea change in direct payments to parents from government that started during the pandemic, post pandemic and in some other policy areas like there's a lot of infrastructure around all the things that go with that eligibility for benefits and compliance in those pieces and that's just across a range of government programs.

Speaker B:But you just don't see that that much in the K12 sector.

Speaker B:And so this is new.

Speaker B:There will obviously be some problems and those will attract a lot of attention, as is often the case.

Speaker B:And it just seems like that's where to your point a moment ago is where there's going to be some growing pains while people, and we've seen that with most of these scholarship programs in general, you've seen in choice programs, there's been some growing pains.

Speaker B:This sort of stuff's gotten figured out.

Speaker C:Yeah.

Speaker C:And I think if I was, if I was talking to some of my friends in the charter space, I would say it also means like when you have payments or a benefit like this, it goes directly to families.

Speaker C:You need to be pretty like small C conservative in how you build this into your operations and your budget.

Speaker D:Right.

Speaker C:Because you're not again, it's not saying, oh, we started this SGO associated with our network of schools in Austin, Texas and now we know that dollar for dollar, whatever we raise comes, right, you know, just as a transfer payment to our network of schools.

Speaker C:That's not how it's going to work.

Speaker C:It goes to parents and parents make that decision.

Speaker C:And even in states with ESA programs, that's something that we've had to really educate private school leaders on.

Speaker C:This is not a private school program, it's a parent choice program.

Speaker C:And now a lot of parents are going to choose your school, they're going to choose your services, but you can't direct them.

Speaker C:The thing that really breaks the chain, frankly, and is really important is that parents get to direct their, their funds.

Speaker A:So the SGO can say, we're going to fund these kinds of things.

Speaker A:This is what our priority is.

Speaker A:But then we give it to the, to the parents.

Speaker A:They are then limited by the funding priorities of the sgo.

Speaker A:Or once they get it, then they do with it what they will.

Speaker C:It's a, that's a good question.

Speaker C:I think there's going to be rules about this, right?

Speaker C:Because they're certainly limited.

Speaker C:What we know is that they're limited by the, by the federal law in terms of use.

Speaker C:If anything, an SGO might be able to place some of the application, you know, limitations, again, say from these zip codes, whatever this part of the state, what, what have you.

Speaker C:But, but even then, I think we're going to learn more about, in the rules process.

Speaker A:Yeah, I've heard of charter school people talking about funding that's not flowing to our schools uniquely, especially around things like transportation.

Speaker A:Okay, let's create an SGO that's going to help parents get to their charter school.

Speaker A:But that would seem to be.

Speaker A:There would be some pretty specific rules there.

Speaker A:And hey, we're going to give it to the parents.

Speaker A:Hey, you're given this funding so that you can spend it on transportation.

Speaker A:But if they chose to do something different, you know, I guess this is the detail that the rule process needs to get into.

Speaker C:Yeah, yeah.

Speaker C:And, and we're just going to have to wait and see a little bit.

Speaker D:Right?

Speaker C:I mean, it might be the kind of thing where you say, hey, good news, we started a new transportation offering, but it might take some startup capital before things really get rolling and you see what the demand looks like and that kind of thing.

Speaker C:But again, there's an opportunity here for some pretty cool practices.

Speaker C:And, and I think, I think the charters will absolutely benefit from it.

Speaker C:I know that there's going to be charter leaders that are doing some innovative things, whether it's these sort of a la carte or unbundled offerings, what have you.

Speaker C:And, you know, if this kind of adds some energy in that space, I think that's a really good thing.

Speaker A:All right, this is cool.

Speaker A:Hey, Andy, what do you think, though?

Speaker A:What do you think about having Shaka back and we try and get Robert Enlow here?

Speaker B:Oh, yeah, I think the charters cup.

Speaker A:And let's, let's just mix it up here on this pr, the design of these private school choice programs and let's sus out the different positions that these organizations have because I think what, what I know AFC is leading on some of the issues.

Speaker A:I wish you guys were even more vocal, you know, on, on the need to prioritize low income students, the need not to give up on academic accountability for, you know, these funds and those kinds of things.

Speaker A:But I don't know any, maybe before the end of the calendar year or something we could, we could get a couple of things before we really mix it up.

Speaker B:Yeah.

Speaker B:Whether you agree or disagree with different schools of thought, I do think people don't fully appreciate often there is a lot of nuance and there's sort of different theories of action around universality versus means tested and targeted and there's people who think different strategies are going to be a better way to make sure it's more inclusive of low income peoples.

Speaker B:And just to sort of, I think to get a few people on to sort of air that I think would be, would be interesting for folks.

Speaker B:Regardless of what you think of any of those questions.

Speaker B:There's just, in my experience there's more nuance to it than sort of the blunt force trauma of like choice versus anti choice sort of reveals.

Speaker C:Yeah, yeah.

Speaker C:And there's also, you know, I dare say this is, this is showing my cards a little bit, but there's also gravity, right?

Speaker C:Yeah, there's, there's just political gravity.

Speaker C:And so, so some of that is like we can have these discussions on X or you know, whatever blue sky or what have you, but the conversation that's had under the Capitol dome, that's, that's where the legislation gets passed.

Speaker D:Right.

Speaker C:And so we can talk all we want about what's going to get us to some sort of like Austrian economic utopia fastest, but then we need to go and translate that to legislators from whatever rural Oklahoma or suburban Tennessee or just wherever.

Speaker C:And so that's where the rubber meets road.

Speaker B:I also think the appetite for choice has changed a lot in ways that I feel like.

Speaker B:So you're right about the decisions and the conversations that happen under the dome are the ones that matter in terms of what gets passed, what the policy looks like.

Speaker B:But I just feel like there's a whole separate conversation.

Speaker B:A lot of the stuff you hear talked about in the policy world like that ship has sailed in terms of what parents are saying they want their own behavior and so all the revealed preferences.

Speaker B:And I feel like you often find yourself in these conversations that feel 10 years old just because the world has just changed a great deal in the last five years.

Speaker C:Yeah, totally agree.

Speaker A:All right, well, this was great.

Speaker A:Shaka, thank you so much for being available for this.

Speaker A:Andy, as always, enjoyed having some time with you.

Speaker C:Super fun.

Speaker B:This was great.

Speaker B:And Shaka, seriously, thank you.

Speaker B:I know it's a busy time of year for you, so making the time for us.

Speaker B:We appreciate it.

Speaker B:Jed, it's always good to see you.

Speaker B:And I will see you soon, online or in person.

Speaker A:All right, sounds great.

Speaker A:Thanks, guys.

Speaker C:Thanks, guys.