Shownotes

Should you rent or buy a home? Prices are surging in both cases, which makes it complicated

Fresno Calif. has had a 23.1% rent increase over the last 12 months which is well above the state of California (11.6%) and U.S. (15.1%) rent increases. The average one-bedroom apartment now costs $1,150.

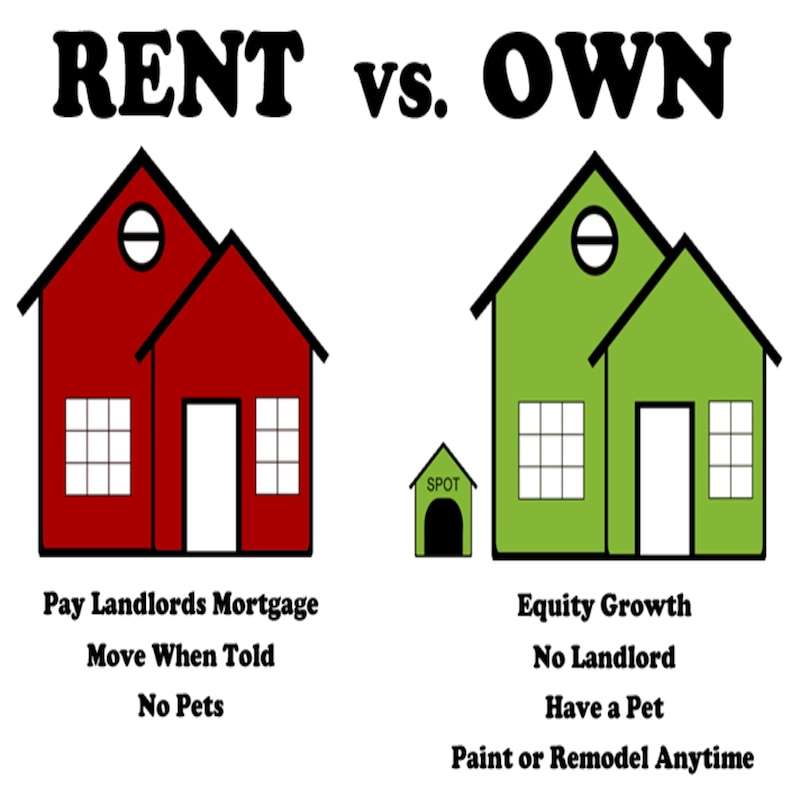

Buying vs Renting

There are limits to how much a landlord in California can increase rent. Every rental property that is not exempt from AB 1482 can only have an annual rent increase of 5% plus the annual Consumer Price Index (CPI) percentage change.

“People who were renting in anticipation of buying a home are still renting because the housing prices have gone up so much; the house they wanted to buy a year ago is 20% more than it was

KEY POINTS

- Home prices are rising faster than rents, which is shrinking the affordability gap between being a homeowner and a tenant.

- Single-family homes are less affordable than they have been in just over three quarters of the U.S. — the highest total in 13 years, according to a real estate data tracker.

- All real estate is local, however. Homeownership is more affordable than renting in suburban and rural areas, but it’s cheaper to rent in big cities.

- Work with a good mortgage loan officer that put your best interest at heart

- Get Pre-approved before home shopping

- Find a good relator that knows the local market

- File two years of tax returns

Home prices are rising faster than rents, which is shrinking the affordability gap between being a homeowner and a tenant.

Median-priced, single-family homes are less affordable in just over three quarters of the nation — the highest total in 13 years, according to ATTOM, a real estate data tracker. That’s up from 39% at the end of 2020.

Rents are also up, especially for single-family homes, which have been in high demand during the pandemic. Single-family rents increased 10.9% in October 2021 compared to the year-earlier period, a sixth consecutive record high, according to CoreLogic. The fall is typically a slow season for housing.

So which is more affordable, owning or renting?

As a tax expert we recommend to use your tax refund as a down payment on a home

Four C's of Qualify for a Mortgage

Whether you are a first-time home buyer or are re-entering the housing market, qualifying for a mortgage can be intimidating. By learning what lenders look at when deciding whether to make a loan, you'll be more confident in navigating the mortgage application process.

- Credit "620 higher FICO score"

- Collateral

- Compacity

- Cash-to-close

Standards may differ from lender to lender, but there are four core components — the four C's — that lender will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

Capacity to Pay Back the Loan

Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to comfortably take on a mortgage.

One of the ways that lenders verify your income is by reviewing several years of your federal income tax returns and W2s, along with current pay stubs. They evaluate your income based on:

- The source and type of income (e.g., salaried, commission or self-employed)

- How long you've been receiving the income and whether it's been stable

- How long that income is expected to continue into the future

Lenders will also look at your recurring monthly debts or liabilities, such as:

- Car payments

- Student loans

- Credit card payments

- Personal loans

- Child support

- Alimony

- Other debts that you 're obligated to pay

Capital

Lenders consider your readily available money and savings plus investments, properties and other assets that you could access fairly quickly for cash.

Having money saved or in investments that you can easily convert to cash, known as cash reserves, proves that you can manage your finances and have funds, in addition to your income, to pay the mortgage. Cash reserves might include:

- Savings

- Money market funds

- Other investments that can be converted to cash, such as Individual Retirement Accounts (IRAs), Certificates of Deposit (CDs), stocks, bonds or 401(k) accounts

Along with cash reserves, other acceptable sources of capital might include:

- Gifts from family members

- Down payment or closing cost assistance programs

- Grants or matching funds programs

- Sweat equity

When you apply for a mortgage, the lender may need to verify the source of any large deposits in your bank account to ensure they're coming from an allowable source. That is, that you obtained the money legally and that it was not loaned to you.

Lenders may also look at the last two months of statements for your checking and savings accounts, money market accounts, or investment accounts to evaluate how much capital you have.

Collateral

Lenders consider the value of the property and other possessions that you're pledging as security against the loan.

In the case of a mortgage, the collateral is the home you 're buying. If you don't pay your mortgage, the mortgage company could take possession of your home, known as foreclosure.

To determine the fair market value of the home you'd like to buy, during the homebuying process your lender will order an appraisal of the property that compares it to similar homes in the neighborhood.

Credit

Lenders check your credit score and history to assess your record of paying bills and other debts on time.

Many mortgages also have minimum credit score requirements. In addition, your credit score could dictate the interest rate that you get and how much of a down payment will be required.

Even if you are a renter, or don't have plans to buy right now, it's a good idea to get smart about credit and know ways you can build and maintain strong credit health.

Credit Strong Credit & Savings

https://mkgtaxconsultants.com/credit-strong-credit-savings/

Transform Your Life With Strong Credit and Savings

Credit Strong helps you build credit as you grow savings.

Choose the plan that works for you

Build credit by saving each month, cancel at any time

Make payments & track your progress

We provide your monthly FICO® Score, for free

Unlock your savings

Once your loan is repaid, your savings are returned